Alenia’s Gamble

To help build the Boeing 787’s composite fuselage, Italy spends a bundle.

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/alenia_388-july07.jpg)

Seeing carbon composite material in its raw form makes it very hard to imagine airplanes built from the stuff. In a brand-new Alenia Aeronautica plant in southern Italy, just outside a town of artisans and olive groves called Grottaglie, hundreds of foot-long spools of paper-thin, half-inch-wide strands wait to be transformed. The material looks like dull-black electrical tape and feels like brittle typewriter ribbon. Wrap those strands around a mold and bake them under pressure in an autoclave, however, and they will meld into a single, super-strong piece of carbon-fiber-reinforced polymer resin, the material that promises to revolutionize the way people make airplanes.

In Grottaglie, the carbon fiber will be used to create two center sections of the fuselage of Boeing’s newest commercial airplane, the 787 Dreamliner. With Japanese and U.S. suppliers building the forward and aft sections from the same material, the airliner’s entire pressurized hull will be made of composites, an industry first.

Alenia’s supply of spools occupies a small fraction of the floor space in a massive clean room, the largest in Europe (at 6.2 million cubic feet, the equivalent, Alenia calculates, of a 3,000-room hotel). The room is protected from dust by reverse-pressure doors. The temperature and humidity are vigorously controlled at 66 degrees Fahrenheit and 60 percent, respectively. If the air were more humid, the moisture could infiltrate the raw polymer, then, as it cooks away during the curing process, leave destabilizing air pockets. If the air were warmer, the resin embedded in the material could start to soften, causing the strands to stick together. In protecting against these hazards, plant managers have made the clean room the most consistently cool place in the entire air-conditioning-averse nation of Italy.

Everyone in the room—supervising executives, engineers testing materials, construction workers assembling manufacturing equipment, gawking visitors—is wearing a white paper lab coat, preparing for the first tests of the composite fuselage sections, just ahead of initial production. Towering pieces of machinery, designed to craft the 28- and 33-foot-long parts of the Dreamliner, stand like set dressing for the 1927 futurist film Metropolis. In fact, everything here is shockingly large, including the stakes. Alenia Aeronautica has invested more than $600 million in the Dreamliner program, most of it spent on this facility and fuselage barrel development. Company executives are betting the investment will net much more than the $1.1 billion contract the company has with Boeing for Dreamliner sections.

The immense responsibility for getting operations here off to a smooth start rests on the slight shoulders of Maurizio Rosini, the chief operating officer of Alenia Composite, a subsidiary formed to spearhead the manufacture of major aircraft structural components from carbon fiber. Rosini has pale skin and white-gray hair. He also has a quick mind, an unflappable demeanor, and an office in each of the three Alenia airplane plants building carbon fiber components. These days, he says, most of his time is spent in this new, gigantic facility in Italy’s boot heel, which employs about 500 and is remaking Grottaglie into a center of the global aeronautics industry.

“This is a new plant, using new machines and new technology,” he says, peering at visitors intently from behind the thick lenses of his glasses. Rosini has the Italian tendency to grip the crook of a listener’s arm to emphasize his points, and does so now, his other hand gesturing at a machine that is bigger than some apartment buildings, rising 118 feet above him. “Look there: Something is happening,” he says.

Behind a clear panel, 32 spools of the carbon fiber begin spinning within the machine. When the factory is ready the following week, the spools will layer the material on a 30-foot mold, or mandrel. The mandrel gives the raw material its final shape.

The composite ribbons unwind in a dizzying mix of computer-controlled patterns to fully coat the mandrel, ply after ply. Exactly how many layers, their total weight, and their pattern neither Boeing nor Alenia will disclose. The first to use composites for as much as 50 percent of an airliner, the 787 builders are very careful not to give away secrets.

“This is a tremendous change,” says 787 program director Guglielmo Caruso, based in Alenia’s headquarters in Rome. “These new aircraft will have the same dramatic impact as the passing from wooden airplanes to metal, or propellers to jets.”

If Caruso is right and the future is in composites, then Alenia Aeronautica’s fortunes rest on the company’s performance during the Dreamliner contract. Alenia must get a factory up and running in time to meet the relentlessly demanding schedule of the 787 program, which requires the coordination of major partners in three nations. Boeing and its partners have committed to delivering 112 Dreamliners by the end of 2009. The first deliveries, to All Nippon Airways, will begin next May, about a year and a half away from Alenia’s pre-production tests. For the aeronautics executives in charge of the daily grind, this is a career maker or breaker.

During a tour of the plant last October, Rosini was bearing the balance of risk and excitement comfortably. Only with considerable prodding did he admit that at night, during his frequent overnight stays near the plant, about 200 miles away from his family in Naples, he could not stop thinking of the long list of tasks that needed to be done at Alenia’s giant facility.

Hundreds of engineers from companies in Japan, Italy, and the United States worked from June 2003 to October 2005 at Boeing’s facility in Everett, Washington, to lock in the final design decisions for the 787. Boeing had determined the requirements: The Dreamliner would seat 250 passengers and fly with ranges and speeds comparable to those of wide-body ocean-crossers like the 747 and 777. It would be economical to operate and maintain because it would be built of lightweight composites (and have super-efficient engines, not then designed). Engineers from all of Boeing’s first-tier contractors figured out how to meet those requirements.

With the Dreamliner, Boeing implemented an even more collaborative approach to building an airliner than the engineering process it used on the 777, famous as the first airliner to be designed and “mocked up” entirely by computer. On the 777, the engineering was concurrent; Boeing gave customers, subcontractors, even maintenance professionals access to computer design files so that problems from any of those quarters—“We can’t build this part that way” or “I can’t reach that light to replace it”—could be worked out in the preliminary phase, before a single rivet was fastened.

On the new airliner, Boeing involved its suppliers not just in the design but in the development of the technology required to build the airplane.

“With the 787, we involved [major contractors] earlier and deeply in the development process,” says Bob Noble, the director of 787 operations within Boeing’s supplier organization, Global Partners. “It allowed us to learn from one another in new ways and allowed very focused investments that will have long-term benefits to the program. I can’t imagine ever doing a program without this kind of partnering.”

Both Boeing and Airbus—the only true prime manufacturers left in the cutthroat airliner industry—have changed the way they work with subcontractors. Instead of hiring a company to supply, say, a wing, the prime asks for the wing plus all the subsystems within it. The giants provide coordination during planning but minimal guidance during execution. They oversee only the first-tier contractors—and expect those contractors to oversee the long chain of suppliers.

“In the new business model, they want to be the guy at the end of the day that just snaps the components together,” says Eric Hugel, who analyzes the aviation industry as vice president of the U.S. investment bank Stephens Inc.

Alenia Aeronautica (a descendant of airplane builders Fiat and Aeritalia) was an obvious choice to be a major player in the 787 program. Besides developing and supplying the outboard flap for the 777, the longest piece of composite structure on the aircraft, Alenia supplied subassemblies for three earlier Boeing airliners and has been a partner on the tanker/transport version of the Boeing 767 since 2001. Partnering with Alenia has helped Boeing reach European buyers; the Italian air force ordered four 767 tanker/transports at about the same time Boeing and Alenia signed the partnership agreement.

Besides fabricating fuselage barrels for the 787, Alenia is tasked with designing and manufacturing the horizontal stabilizer, and also performs static and fatigue trials on the piece. Alenia is the only supplier engaged in this level of complex testing on Boeing’s behalf. The fabrication work is being done in a plant in the town of Foggia, while the testing is done at a facility outside Naples.

As part of the state-owned conglomerate Finmeccanica, Alenia has sometimes suffered from the layers of bureaucracy and political pressures imposed on a nationalized industry. In Italy, as elsewhere in Europe, politics directly affects a company’s strategy. Through a process known as concertazione (consensus formation), in 1993 labor unions secured a powerful voice in the government’s formation of economic and social policy.

“The system operates to discourage changes such as relocations and the entry of new firms,” wrote Edmund Phelps, last year’s Nobel Prize winner for economics, in an opinion piece for the Wall Street Journal. “What it lacks in flexibility it tries to compensate for in technological sophistication.”

That philosophy explains the large investments—courtesy of the Italian taxpayers—in cutting-edge machines and techniques. “We looked around the world for partners who understood composite technologies, had experience with commercial airplanes, and had the corporate will to engage in a complex industrialization effort,” says Noble of Global Partners. “Alenia fit the requirements.”

The speed at which the company has moved on the Dreamliner project defies the image of a plodding Italian company, made sluggish by politicians and bureaucrats. A year and a half after its groundbreaking, the Grottaglie manufacturing center, with an area the size of two dozen American football fields and 40 million pounds of structural steel in its bones, produced the first pre-production fuselage sections for the 787. “I think Boeing was surprised by the speed,” says Antonio Perfetti, Alenia Aeronautica’s chief operating officer. “This was not expected from ‘those Italians.’ ”

Nor was this the first time “those Italians” had done something out of the ordinary. Airbus Industrie, a consortium of European-owned aviation companies, has long courted Alenia to become a full partner, but the company has steadfastly (yet politely) refused. Hugel points out that Alenia is sacrificing the security that comes with such a permanent partnership:

“It’s a ‘sure thing’ versus a risk that you’ll get nothing.”

Alenia has developed new manufacturing capabilities and experience to be attractive to both Airbus and Boeing. “The investments for these new technologies are huge,” Hugel says. “Why apply them to only 50 percent of the market when you could get 100 percent?”

Alenia has joined with EADS to produce the ATR regional turboprop and has supplied components to almost every airliner in the Airbus family. It is a partner with U.S. military contractor Lockheed Martin on a medium tactical military transport, the C-27J Spartan. It built the composite wings of EADS’ Eurofighter—experience that helped convince Boeing that the company knew how to work with composites. Most recently, Alenia formed its own joint venture—with Vought Aircraft Industries in South Carolina. The new company, Global Aeronautica, will join the 787 sections being manufactured around the world.

Alenia’s willingness to dance with any partner has earned the scorn of European governments that treat their state-owned industries as tools of diplomacy. That’s where Alenia’s manufacturing capabilities come into play. Because of the company’s factories and its broad experience, European and U.S. companies alike have continued to ask to become partners.

“In the past we were accused of being a two-faced company. I think this is a very stupid criticism,” says Perfetti. “What was once perceived as a negative is now perceived as a point of strength.”

Alenia’s partnerships are not permanent alliances, like those in the Airbus consortium; they are based on individual products, what Giorgio Zappa, former company president, called “opportunistic partnerships.” Company officials today credit Zappa, who became chief operating officer of Finmeccanica in late 2004, with resisting a monogamous relationship with Airbus and forging Alenia’s independent direction.

When Alenia was breaking ground for its new aircraft factory in 2005, Grottaglie was best known for olive oil (the dark, unfiltered kind) and ceramics. Grottaglie’s residents have not yet caught up with their town’s transformation into a center of heavy manufacturing wizardry. Their favorite pastimes seem to be peering out of doorways and making plates decorated with saints or roosters. Rows of gnarled, thousand-year-old olive trees separate the town from the three massive factory buildings, all colored Alenia blue. The trim of the door and windows, the outside stairs, and the fences are all the same hue; the company is aware of the power of branding. New grass grows around the entrance.

Inside the main building of the manufacturing center, natural light pours from the ceiling 80 feet above, bathing new industrial machinery. Great empty spaces surrounding the machines will one day be occupied by duplicate pieces of equipment, if the contracts multiply. “Automation is key for one-piece technology,” Rosini says, referring to the innovative method of making whole, circular sections. “We will reach a very high rate of production in a short time. The days of slow starts are over.”

The clean room, where the most delicate work will be done, takes up about a third of the building. “The clean room area is the heart of the building,” Rosini says. “And the heart of the process is the mandrel.”

The mandrel is etched with the precise details of the fuselage, including recessed shapes that later will be cut to form the doors and windows. Unlike the mandrels used by other Boeing partners, Alenia’s has been designed to collapse, freeing the composite form without the need to disassemble the underlying structure. Think of melting a candle over a balloon, and then deflating the balloon to separate the layer of wax in one shaped piece from the template beneath it. The design saves production time and preserves the details of the form.

The composite material, delivered to nearby Brindisi airport in refrigerated cargo airplanes, is loaded into a machine that dispenses the fiber. The machine’s robotic arm, suspended from a gantry, moves along the length of the mandrel, laying the carbon fiber strips with absolute precision. The mandrel rotates to give the robotic arm access to all sides. A scaffold surrounds the mandrel, and stairs allow technicians to monitor the placement machine’s activity.

The head on the robotic arm does not appear to be very dextrous—a clamp, guide wheels, and loops of wire. But the device weaves about 85 feet of fiber per minute, using laser guidance and computer software to cast the composite tape with the speed and spirit of an orb spider spinning a web.

The fibers of a single ply point in one direction, but the fibers of the next layer run in another direction to make the skin resistant to bending forces (just as the layers of wood fibers in plywood are laid in alternating directions). The thickness of the composites throughout the airplane varies from one-quarter inch to more than an inch, depending on the load each area must bear. No matter where on the composite form stress is imposed, there will be a pattern of plies that is especially resistant to it.

The placement and orientation of the fiber strips are not the only way to handle stresses caused by openings in the fuselage structure—doors, windows, and other holes. The composite skin is reinforced by composite ribs called stringers, which run longitudinally to stiffen the weaker areas adjacent to the openings. An automated system of cranes within the towering fiber placement machine places the long carbon fiber stringers on the mandrel before “lay up” of the fibers. There are more than 100 stringers in each fuselage component.

Between uses, the mandrel stands as passive as an Easter Island statue. It is made from a nickel alloy, which is stable in extreme temperatures. When the composite piece is fired at 350 degrees Fahrenheit, the mandrel will be heated too, and it must not bend or buckle during the process. “In all other materials there is deformation, and we must be very precise,” Rosini says. All pieces must be within a tolerance of 0.3 millimeter.

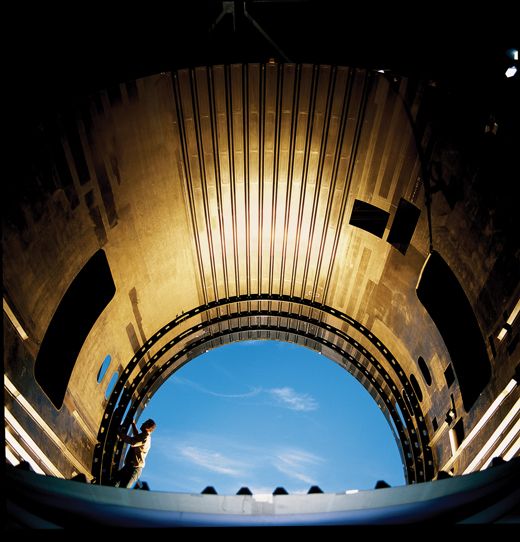

An automated vehicle ferries the composite form and mandrel slowly toward the autoclave. Before leaving the clean room, the form is covered by a bag to keep impurities out. At 64 feet long, the autoclave is Europe’s largest. The barrel slips into the oven like a shotgun shell into a chamber. The oven’s round door looks like it belongs at the blast-hardened entrance of a NORAD bunker. It is, of course, painted Alenia blue.

The strips of carbon fiber material are impregnated with resin, which will ooze out when heated in the autoclave to form the matrix—the binding substance in a composite that holds the reinforcing elements, in this case polymer resin that holds the strips of carbon fiber. In the finished product, the resin matrix will serve as a bridge to ferry the stress of a load across a break if the carbon fibers snap. The heat and pressure of the autoclave are vital for the stability of the final product. The heat melts the resin, which is designed to retain its form when it softens, unlike a common plastic. The pressure drives out air pockets by pushing the resin into any microscopic voids that may lie between the carbon strands. Air pockets could create weak spots, forming cracks that could spread and jeopardize the entire piece.

After a 16-hour bake, the mandrel is removed from the autoclave, and the heat-resistant bag is removed.

The mandrel and now-cured fuselage section stay connected as they are brought to a 160-foot-long machine that shaves away composite to create openings for windows and doors. Several days after the process started, the form is placed into two fuselage-size rings—think Stargate—that will preserve its shape once the mandrel is collapsed and removed. The rings hold the not-yet-rigid airplane section while the work continues and quality control inspections begin.

When the sections are finished, Boeing’s modified 747 freighter, the unsightly Dreamlifter, will fly them to the new Alenia-Vought plant in North Charleston, South Carolina. There, approximately 350 workers will assemble, integrate, test, and apply surface finishes before sending joined sections on to Everett, where all the pieces will be put together.

As Alenia begins production of 787 parts, it is also negotiating a role on the 787’s rival, the Airbus A350. For the Boeing contract, the company benefits from a happy accident of geography. The 787 project demands time-zone straddling conference calls between South Carolina, Japan, Everett, and Italy. The best time to get all the partners together at once, Caruso notes, turns out to be daytime in Italy. “We are in the best location for conference calls,” he says. In other words, he feels Alenia is right in the middle. Just where it wants to be.