The space race is reigniting, catalyzing changes in the new space economy. The industry stagnated after the major scientific and commercial achievements of the 20th century, but new players and technology are reopening space as the next frontier.

Noah Poponak, the senior Aerospace and Defense analyst at Goldman Sachs Research, describes space as becoming “smaller, closer, and cheaper” as the industry reinvents itself. Poponak explains that diminishing barriers to entry—combined with geopolitical tensions—have led to a renewed focus on space activity, with major implications for scientific research, defense, and communications. Launch-to-orbit costs, the greatest hurdle for new entrants, have fallen to less than 10 percent of what they were five years ago and are likely to continue dropping as new technologies like reusable rocketry are introduced, opening space to new applications, technologies, and competitors.

Goldman Sachs Research’s Noah Poponak explains the factors reigniting the space race.

Breaking down barriers (and why that matters)

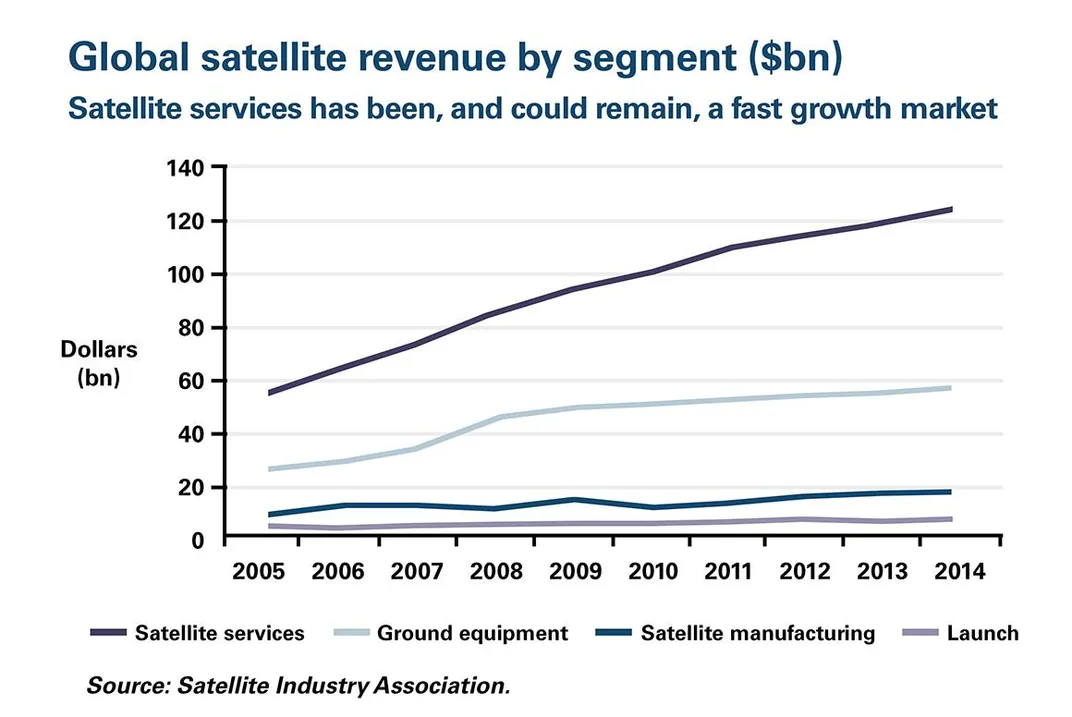

Greater accessibility could radically change the competitive landscape in space. Until recently, only a handful of companies and countries were large enough to invest in space-based assets. But now lower launch costs and the emergence of low-cost small satellites are creating opportunities for new commercial, military, and scientific ventures. Poponak sees the space economy as generally elastic, meaning that a decrease in price triggers disproportionate demand for space-based assets. This, in-turn, increases the supply of services like GPS, satellite Internet, and precision mapping. To put that increase in perspective, in 2011, there were 986 satellites in orbit, according to the Satellite Industry Association. By 2014, that number had increased to almost 1,300. Several companies have announced plans to deploy new orbiting constellations consisting of thousands of satellites.

So space is not just becoming closer and cheaper—it is also becoming more crowded.

Defense spend

With space becoming more congested, Poponak expects asset protection will contribute at least $5.5bn to the US Defense budget over the next five years. This amount is likely to be allocated within the classified budget, and will create new opportunity for defense names. US Space Command has already grown to roughly the same size as the Coast Guard with about 2.5 times the budget. Because space spending is closely linked to national security threats from near-peer countries, we see the resurgence of Russia and rise of China as important tailwinds to Pentagon spending in space. Both countries have successfully tested anti-satellite weapons, exposing the risk to US space assets. Part of the US defensive strategy in space is the distribution of its architecture across numerous satellites, including commercial platforms.

Privatization

Privatization of space creates near-Earth commercial opportunity and enables NASA to venture further out. As NASA pushes deeper into space, private firms are filling in, taking over responsibility for transport and services to low Earth orbit, seen clearly in the commercial resupply and commercial crew awards. The last US-launched human spaceflight was the final shuttle mission in 2011. But that is set to change with imminent commercially-operated flights to the International Space Station and the development of the Space Launch System, the next-gen exploration class rocket, which will bring Americans to asteroids by 2025 and Mars in the 2030s.

“Overall, it’s a really fascinating time in space,” Poponak said. “There’s a lot going on, a lot of investment, a lot of innovation so it’s really looking like space is, again, reigniting.”

Other dimensions

The new space race is just one of the themes discussed in Goldman Sachs Research’s “What If I Told You…” series, which explores emerging trends that are poised to fundamentally change how we live and work.

For more on trends shaping markets, industries, and the global economy, subscribe to BRIEFINGS for weekly insights delivered to your inbox, check out the Goldman Sachs podcast on iTunes and Stitcher, or visit GoldmanSachs.com.

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/68/54/6854ed65-fad5-451f-bce7-2229f6ba21cd/goldman-space-scnshot1.png)